By donating* to OSF, you’re helping provide scholarships to Oklahoma students and families in desperate need.

Yes, you’ll receive big tax credits & deducations by donating to OSF — but you’ll also feel good knowing you’re making a major impact on children’s lives!

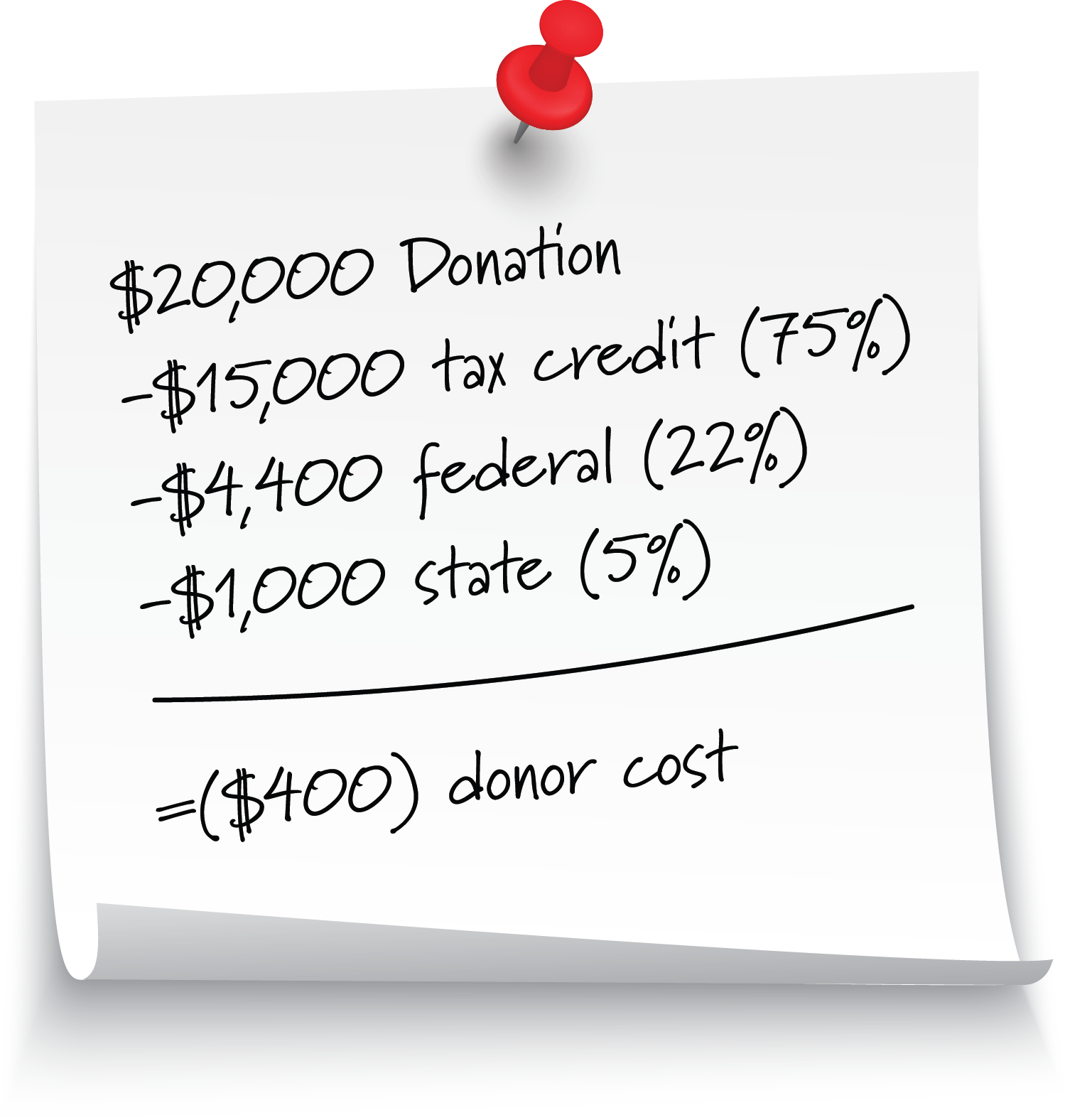

Sticky note assumes a non-itemized tax deduction, treated as a business expense with a two-year commitment of $20,000/year.

Ways to Give

Individuals, married couples filing jointly and qualified business entities in Oklahoma are eligible to donate to OSF. No matter how you choose to give, you must first set up your account via our donor portal or click here to download a physical donor form for mail-in donations.

You can choose a specific school or designate your contribution to support KIDS IN CRISIS. These children need financial assistance to immediately switch learning environments due to severe social, emotional, physical, spiritual or educational needs.

Donate Online

Click here to make a secure donation. You can donate via credit card, automatic clearing house (ACH) debit or wire deposit. You must donate by December 31 to receive tax credits for that year.

Mail a Check

Set up your account via our donor portal and indicate the amount and that you prefer to send a check for your donation. Make the check payable to the Opportunity Scholarship Fund. Mail to OSF, Attn: Gift Processing, 7633 E 63rd Place, Ste. 300, Tulsa, OK 74133. Important: Checks must be postmarked by December 31 to receive tax credits for that year.

Transfer Appreciated Stocks

Set up your account via our donor portal and indicate you prefer to transfer appreciated stocks or other marketable securities to an OSF brokerage account for conversion to cash. Donation amount will be provided after shares are received. Important: You must provide the number of shares and the ticker number on your donation submission. Appreciated stocks must be transferred by December 31 to receive tax credits for that year.

Utilize IRA-Required Minimum Distribution

If you’re 72 years of age or older, the required minimum distribution from your IRA can be donated to OSF tax free. Set up your account via our donor portal to indicate the amount you’d like to donate. IRA distribution checks must be postmarked by December 31 to receive tax credits for that year.

Business Donations

Are you interested in donating to OSF through your business? Click the button below to view resources and learn more.

FREQUENTLY ASKED QUESTIONS

How much can I give to maximize my tax credit?

- $2,000 if filing single with a one-year commitment

- $1,333 if filing single with a two-year commitment

- $4,000 if filing jointly with a one-year commitment

- $2,667 if filing jointly with a two-year commitment

- $200,000 if filing as a qualified business and making a one-year commitment

- $133,333 if filing as a qualified business and making a two-year commitment

One-year commitment = 50% tax credit; Two-year commitment = 75% tax credit

The maximum amount of tax credits you can receive varies by filing status.

- Single: $1,000

- Jointly: $2,000

- Qualified business: $100,000

What form do I submit to claim my tax credits?

To claim your tax credits, you are required to fill out and submit Form 511-CR. Click here to download the form.

Can my donation be designated to a specific school or student?

You can choose one or multiple schools and/or designate your contribution to support KIDS IN CRISIS — there are children right now who are being actively bullied or falling behind in school who need to immediately switch learning environments but don’t have the necessary funds.

Internal Revenue Service (IRS) code regulations do not allow for particular individuals to receive direct benefits from a donor gift.

How is my donation allocated?

The Scholarship Act requires OSF to disburse at least 90% of the money it receives each calendar year in the form of scholarships for eligible students during the following academic year. A scholarship-granting organization cannot retain more than 10% of contributions to pay its administrative costs.

What is the difference between a tax credit and a tax deduction?

Tax credits directly reduce the taxes you pay on a dollar-for-dollar basis. For example, if you owe $4,000 in state income tax but have a $1,000 tax credit from the State of Oklahoma, you can pay off $1,000 through credits and only pay $3,000.

Tax deductions can reduce the amount of your income before you calculate the tax you owe. However, the value of tax deductions depends upon factors specific to each taxpayer.

Both tax credits and tax deductions help reduce the overall taxes you pay, but tax credits are much more valuable because they directly reduce your taxes dollar-for-dollar.

When can I use my tax credit?

The tax credit you get for donating to OSF may be claimed when you file your tax return the following year. For example, tax credits received from a 2022 OSF donation may be used to offset income taxes on your 2022 Oklahoma tax return filed in 2023.

The tax credit is good up to the state tax liability. The tax credit from a scholarship granting organization is not refundable. A non-refundable tax credit is a tax credit that can only reduce a taxpayer’s liability to zero. You may only use this tax credit to offset Oklahoma income taxes. Any tax credit not used in a given tax year due to no tax liability may be carried over for up to three years.

What’s the deadline to contribute and still get a tax credit?

Donations must be postmarked on or before December 31. OSF must report gifts to the Oklahoma Tax Commission on January 10, of the following year, to be credited in the year donated.

The tax credit you get for donating to OSF may be claimed when you file your tax return the following year. Federal and state tax deductions for your charitable contribution to OSF may also be claimed if you itemize when filing your annual tax returns.

Do tax credits carry over?

You have 3 years to apply your tax credits, and the clock starts the year after your donation. So, for example, tax credits received from 2023 donations must be used by 2026.

What is a "proration carryover" and how does it work?

Tax credit proration occurs when Scholarship Granting Organizations (SGOs) like OSF collectively exceed the tax credit cap allowed by law. Between tax years 2013 and 2021 donors were subject to a “proration” due to exceeding the then $5 million tax credit. Donors who wished to use their tax credits could not use the full amount. For one year, the remaining credit was carried over to the next tax year. Click here to view proration information dating back to 2013 (expand the tab labeled, “What is the Oklahoma Equal Opportunity Education Scholarship Credit?”).

In 2022, the tax credit was raised collectively from $5 million to $50 million.

What does Oklahoma SB 1659, the Oklahoma Equal Opportunity Education Scholarship Act, say about tax credits?

The Oklahoma Equal Opportunity Education Scholarship Act (68 Okla. Stat. §2357.206) (SB1080) allows individuals and businesses to receive Oklahoma state income tax credits for donating to a scholarship granting organization (SGO) recognized by the Oklahoma Tax Commission. The SGO then uses those contributions to provide scholarships for eligible students to attend an accredited private school. Bill language states: “Tax credits which are allocated to such equity owners shall only be limited in amount for the income tax return of a natural person or persons based upon the limitation of the total credit amount to the entity from which the tax credits have been allocated and shall not be limited to One Thousand Dollars ($1,000.00) for single individuals or limited to Two Thousand Dollars ($2,000.00) for married persons filing a joint return.” Click here to view the full statute.

Is donor information shared with schools?

Yes. Unless a donor gift is designated as “anonymous,” schools will receive your contact information to acknowledge your gift(s).

How do tax credit scholarship programs benefit the state budget?

An independent fiscal impact study found the return on investment is an estimated 51%! For every dollar of tax credit allowed, the state benefits by $1.51. These savings help fund other government priorities, like public education.